Welcome To 125 Plan

125Plan is a leading provider of wealth management programs in the USA. We specialize in offering comprehensive Section 125 Preventive Wealth Management Programs that are designed to enhance financial well-being for employees and provide significant tax savings for employers. Our approach is rooted in the belief that financial health is as important as physical health, and we are dedicated to helping organizations foster a financially secure and educated workforce. At 125Plan, we believe in the power of proactive wealth management. Our mission is to provide innovative solutions that prioritize and incentivize preventive wealth care for employees, while also delivering substantial benefits to employers.

STEPS IN OUR WELLNESS PROGRAM

Employee Makes Erisa Qualified Contribution Premium For A Self-Funded Group Plan. Employee Takes Health Risk Assessment For Participation In Wellness Program.

Employee and His/Her Spouse Gain Access To A Range Of Wellness Benefits Specified In The Plan. Employee Consults With A Nurse And/Or Receive Medical Care.

Employee Receives Post Tax Claim Payment (213D) And Accrued Flex Credits From His/Her Employer. The Claim Payment Allows Employees To Purchase Non-Taxable Qualified Defined Benefits.

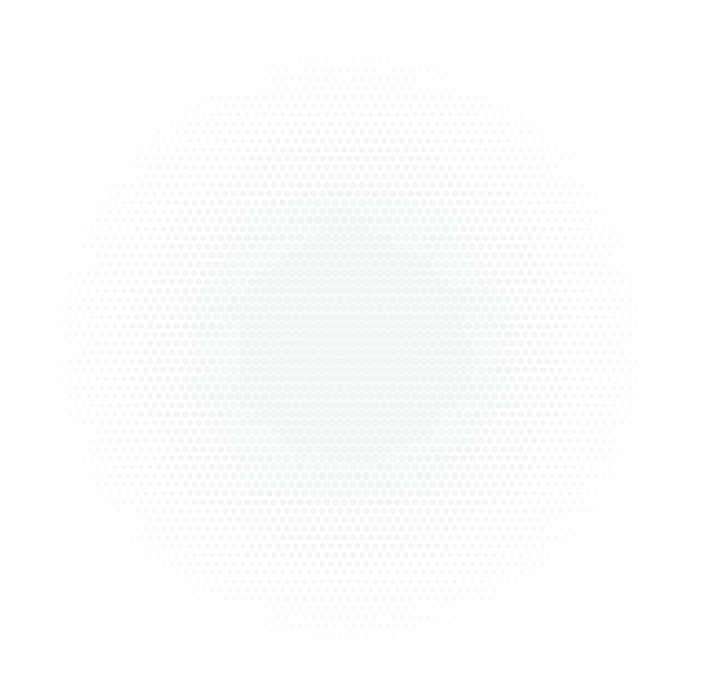

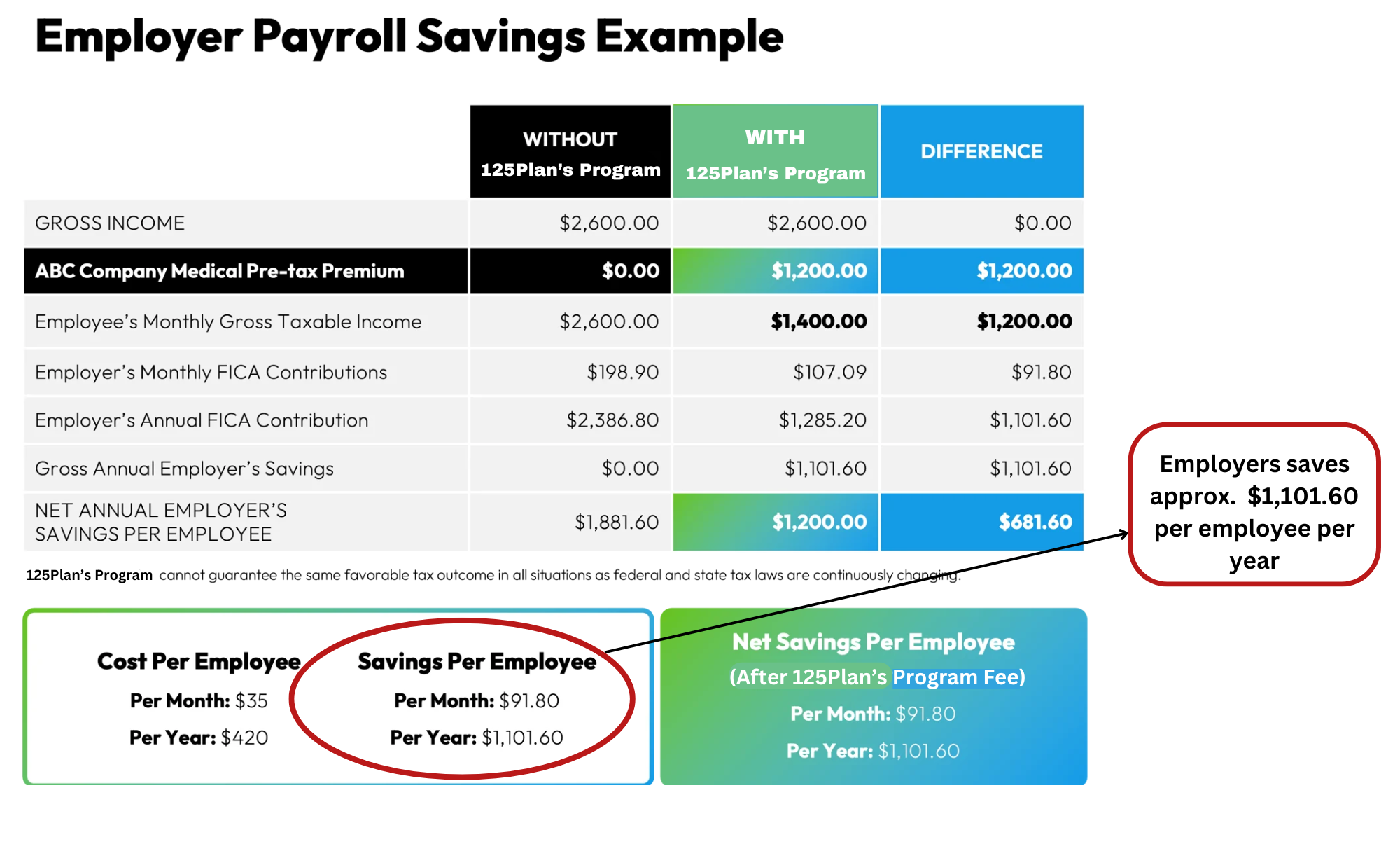

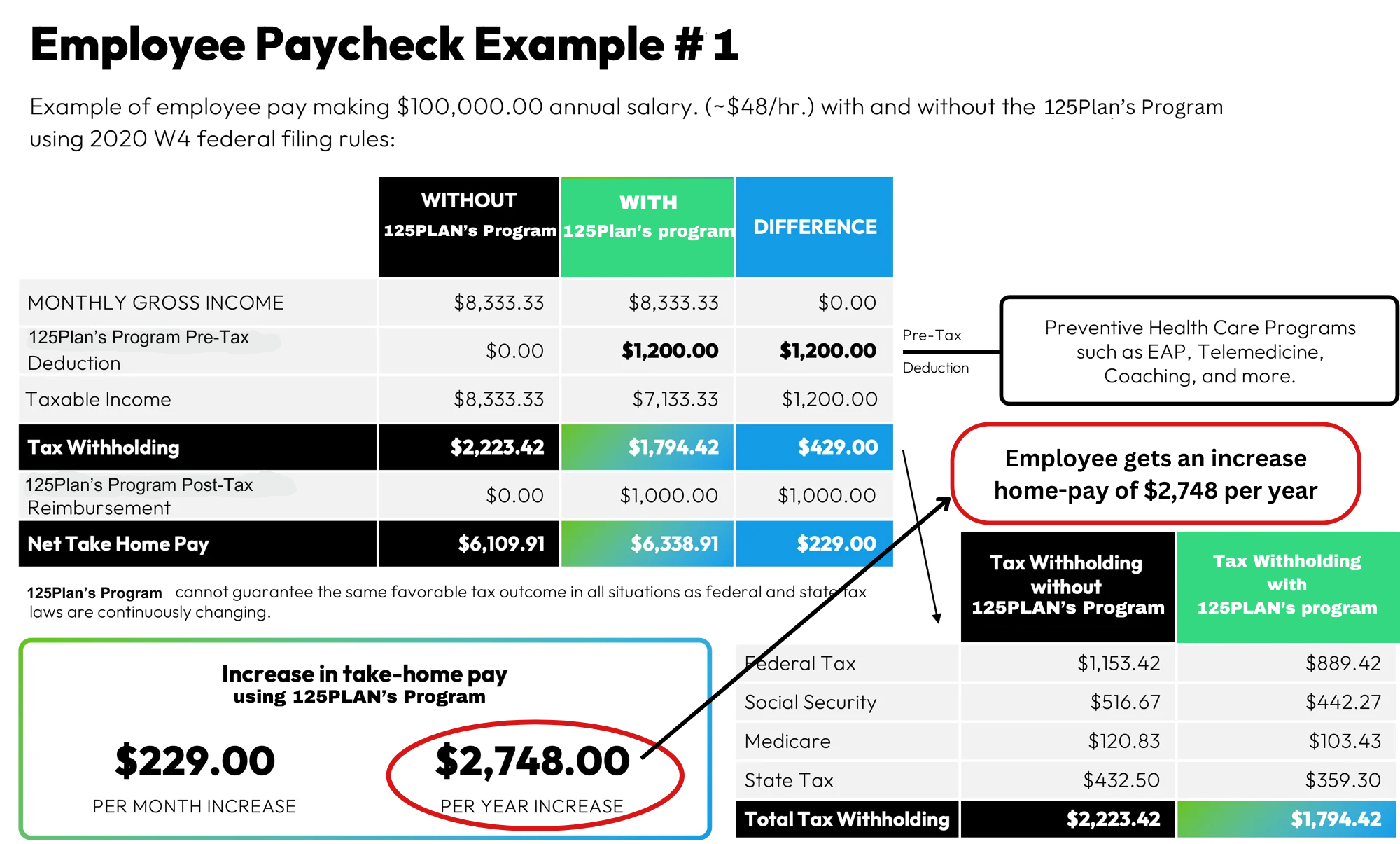

See the difference the 125Plan's Program

can make.

Let's speak

with experts

in the field.

Discover the perfect insurance solution

tailored to your needs.

Fill out our simple form to receive a personalized quote

and secure your peace of mind with 125Plan.

CALL FOR ADVICE NOW!